Helping You

Invest in Your Future

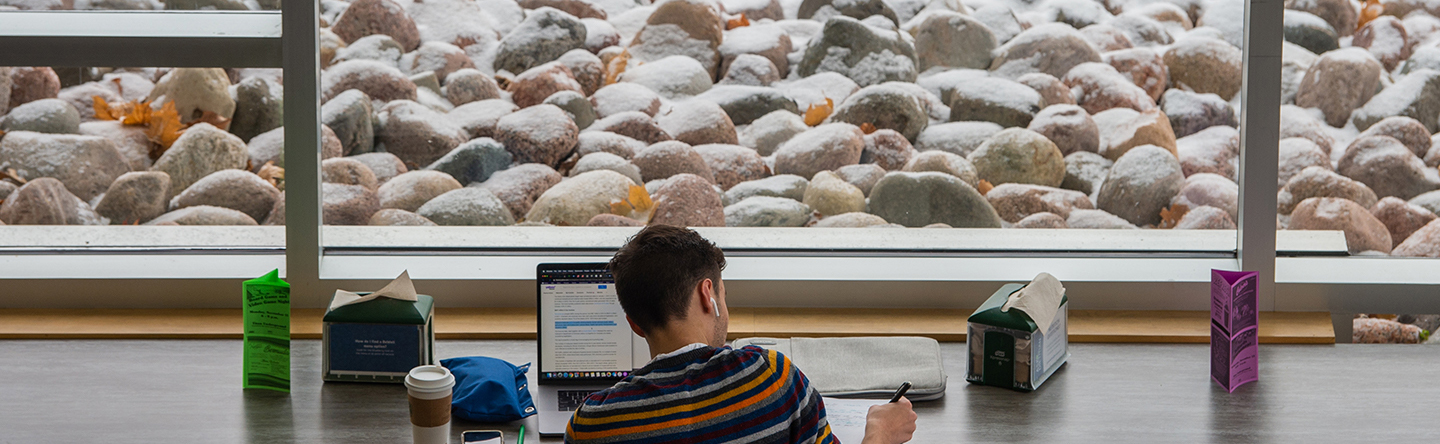

Welcome to the Financial Aid Office at UW Oshkosh

The mission of the Financial Aid Office is to provide current and helpful financial information to students and families in order to meet the costs associated with attending the University of Wisconsin Oshkosh, regardless of financial need. We seek to provide access to all types of financial assistance to undergraduate and graduate students alike in a caring, personal, and professional manner.

Find Resources For…

New and Returning Students

Parents and Families

Alumni and Former Students

FAFSA

Federal School Code

#003920

Hours and Location

Dempsey Hall, Room 104

Walk-In Hours:

Mondays and Fridays

8:00 a.m.–4:00 p.m.

Tuesday, Wednesday, Thursday

10:00 a.m. - 3:00 p.m.

Schedule an appointment with your fiancial aid Counselor

Office Hours: 8 a.m.–4:30 p.m.

Mailing Address

Financial Aid Office

UW Oshkosh

800 Algoma Blvd.

Oshkosh, WI 54901