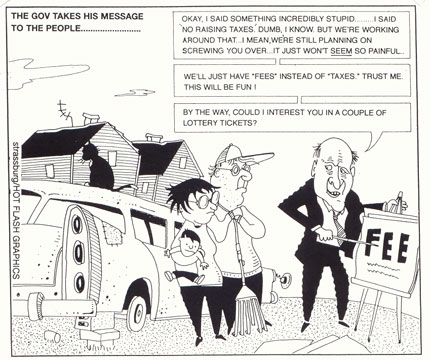

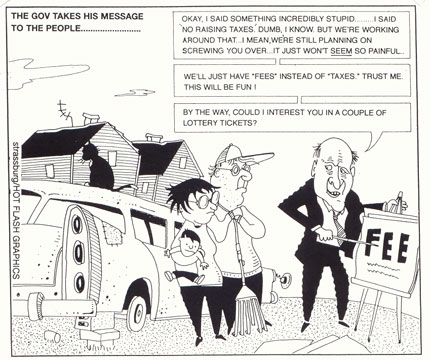

Tax Fairness Failure

Media Rants by Tony Palmeri

From the April, 2003 edition of The Valley

Scene

Listening to Jim "The New Democrat" Doyle and the Wisconsin legislature, you'd think that we the people are too stupid to recognize the politicians' "no tax increase" promise as a pathetic smokescreen. Doyle wants a $526 million fee increase (including massive Republican endorsed UW tuition increases), while the Republican Caucus' plan for deep cuts in the state's shared revenue program will force local governments to squeeze more from the little folks. In Madison's madcap world, this constitutes "no tax increases."

Contrast Doyle and the Republicans' shameful shell game with Bob LaFollette. Chapter 7 of Fightin' Bob's 1912 Autobiography ("How We Passed The Railroad Taxation Laws") gives us a governor and legislative majority willing to confront the corrupt corporate control of the budget. LaFollette describes how getting Wisconsin out of debt took "years of struggle" against corporate interests. But when the dust cleared, "we brought in so much property hitherto not taxed or unequally taxed that, while the expenses of the state have greatly increased, still the burden of taxation on the people has actually decreased . . . Wisconsin today leads all the states of the union in the proportion of its taxes collected from corporations. It derives 70 percent of its total state taxes from that source . . . "(emphasis added).

By the time Tommy Thompson got through rolling back every last piece of progressivism

in the tax code, corporate contributions whittled down to 4.2% of the total

tax intake. Tommy's Administration secretary Mark Bugher told the Milwaukee

Journal Sentinel that the corporate tax is "so shot full of exemptions

and loopholes and credits and exceptions and complications that it becomes almost

irrelevant to the revenue stream of the state."

Doyle and the Republicans apparently intend to continue in the Thompson tradition

of big business tax breaks and snow jobs for the rest of us. They can get away

with this because the corporate press allows them to. While the LaFollette Progressives

had to fight an establishment press providing cover for corrupt political bosses,

the majority in the legislature and Governor LaFollette were in sync with tax

fairness "muckrakers."

Today, tax fairness muckrakers tend to be relegated to small circulation newspapers,

the Internet, low budget think thanks, and academia. Meanwhile, the mainstream

corporate media give favorable treatment to studies supporting the Wisconsin

Manufacturers and Commerce (WMC) position on taxes while the same media minimize

studies that expose how regressive our tax system really is.

Consider two studies released early in 2003: one by the Wisconsin Policy Research

Institute (WPRI), the other by the Institute on Taxation and Economic Policy

(ITEP). The WPRI study argued that if the state were to try to mend its budget

deficit by increasing sales and income taxes, over 84,000 people would lose

their jobs. WMC's Jim Pugh said "This study clearly shows those tax increases

are job killers." In a Jan. 23 editorial the state's most influential newspaper,

the Milwaukee Journal Sentinel, used the WPRI study as support for no tax increases:

"But any impulse to solve this problem with higher taxes ought to be resisted.

A study released this week by the Wisconsin Policy Research Institute suggests

some reasons why."

Though the WPRI has deep Republican roots and has received millions of dollars

from the conservative Bradley Foundation, New Democrat Doyle parroted their

tax study in his January 30th State of the State address: "Wisconsin is

already one of the nation's most heavily taxed states. Adding to the burden

would make it virtually impossible to attract new jobs while destroying more

than 50,000 of the ones we already have." Not until February 8th did the

Journal Sentinel allow significant criticism of the WPRI report. An op-ed by

Economist Michael Rosen questioned the report's assumptions and chided the Journal

Sentinel for how the paper "uncritically accepts its [the WPRI study] assertions.

No economists who are critical of the report's methodology are quoted."

The Institute on Taxation and Economic Policy study, minimized, misrepresented,

or maligned in the press, showed that in 2002 the richest 1% of Wisconsin taxpayers

paid 8.1% of their income in state and local taxes, and only 5.9% after federal

itemized deductions. Middle-income taxpayers paid 11.9%, or 11.3% after the

federal offset. The poorest 20% of taxpayers paid 10.2%.

Since more "liberal" foundation monies and individual contributors

support ITEP, one might expect a Democratic governor or the Democrats in the

legislature to endorse the study. We won't hear an endorsement, and here's why:

as reported by the Wisconsin Democracy Campaign (www.wisdc.org), "all sectors

of the business community - finance, manufacturing, construction, retail and

service - have contributed $29,171,939 to candidates for the Legislature and

statewide office between 1993 and Aug. 26, 2002."

The truth is that a progressive tax system would not only cure our budget deficit,

but also allow us to reduce taxes for the majority of Wisconsinites. We know

that Doyle and the legislature won't stand up to their corporate masters, so

it's time for editorial writers and reporters to stand up to their own. As noted

by LaFollette, "one would think that in a democracy like ours, people seeking

the truth . . . would find the press their eager and willing instructors."

Tony Palmeri is an Associate Professor of Communication at UW Oshkosh and Co-host of "Commentary," a campus public affairs program.